Banking Industry

Comprehensive Guide to Banking Chatbots: 2024

What are Chatbots in Banking?

Chatbots in banking are AI-powered virtual assistants designed to interact with customers, providing instant support and information. These chatbots leverage natural language processing (NLP) to understand and respond to customer inquiries, offering a seamless and efficient way to handle various banking tasks. From answering common questions to assisting with transactions, chatbots are becoming an essential tool in the banking industry.

How Chatbots Solve Common Banking Pain Points

- Long Onboarding Processes: Chatbots streamline onboarding by guiding new customers through form filling, document submission, and account setup quickly and efficiently.

- High Volume of Inquiries: By managing routine inquiries, chatbots reduce the load on human agents, allowing them to focus on more complex issues.

- Inconsistent Support Quality: Chatbots provide uniform support across all communication channels, ensuring customers receive consistent service every time.

- Operational Costs: Automating routine tasks with chatbots reduces the need for large customer support teams, thereby lowering operational costs.

How a Banking Chatbot Can Benefit Your Business

- Enhanced Customer Experience: Provide 24/7 support, reduce wait times, and offer personalized assistance.

- Increased Efficiency: Automate repetitive tasks, freeing up staff to handle more complex issues.

- Cost Savings: Lower operational costs by reducing the need for extensive customer service teams.

- Data Insights: Gather valuable data on customer interactions to improve services and products.

Conversational AI in Banking

Conversational AI takes chatbots a step further by enabling more sophisticated interactions. These AI systems can understand context, manage multi-turn conversations, and even detect customer emotions to tailor responses accordingly. In banking, conversational AI can handle complex queries, provide financial advice, and assist with personalized product recommendations.

Seeking More Best Practices for Your Chatbots?

- Ensure Security: Implement strong security measures to protect customer data.

- Continuous Training: Regularly update the chatbot’s knowledge base to keep up with new products and services.

- Human Oversight: Maintain a human-in-the-loop approach to handle complex or sensitive issues.

- User Feedback: Collect and act on user feedback to continuously improve the chatbot’s performance.

Use Cases of Chatbots in Banking

- Account Opening Assistance: Guide new customers through the account opening process, providing information on required documents and answering any related questions.

- Fraud Detection and Alerts: Monitor transactions for suspicious activity and alert customers in real-time, providing steps to secure their accounts.

- Loan and Mortgage Applications: Assist customers with loan and mortgage applications, offering guidance on required documents and eligibility criteria.

- Personalized Financial Advice: Provide personalized financial advice based on customer spending patterns, savings goals, and financial history.

- Transaction Dispute Resolution: Help customers dispute transactions, providing information on the steps required and status updates on their disputes.

- Foreign Exchange Services: Provide real-time exchange rates, assist with currency conversions, and guide customers through the process of international transfers.

- Credit Card Management: Help customers manage their credit cards, including activating new cards, checking balances, and making payments.

- Investment Services: Offer investment advice and help customers manage their investment portfolios, providing updates on market trends and performance.

- Savings Goals and Budgeting: Assist customers in setting savings goals and creating budgets, offering tips and reminders to help them stay on track.

- Branch and ATM Locator: Help customers find the nearest bank branches and ATMs, providing directions and information on services available at each location.

- Bill Payment Assistance: Guide customers through the process of setting up and making bill payments, ensuring timely and accurate transactions.

- Regulatory Compliance: Provide information and updates on regulatory compliance requirements, helping customers and businesses stay informed and compliant.

- Customer Feedback and Surveys: Collect feedback from customers about their banking experience, helping the bank improve its services and offerings.

- Insurance Services: Assist customers with selecting and managing insurance products, providing information on coverage options and claims processes.

- Financial Literacy Programs: Offer educational resources and programs to improve customers’ financial literacy, covering topics like saving, investing, and credit management.

- Wealth Management: Provide high-net-worth individuals with personalized wealth management services, including investment strategies and estate planning.

- Debt Management: Help customers manage their debt, providing advice on repayment strategies and options for consolidating debt.

- Customized Alerts: Allow customers to set up customized alerts for account activity, such as large transactions, low balances, or upcoming payment due dates.

- Voice Banking: Enable customers to interact with the chatbot using voice commands, making it easier to perform banking tasks on the go.

- Customer Onboarding: Guide new customers through the onboarding process, ensuring they are familiar with the bank’s services and how to use them effectively.

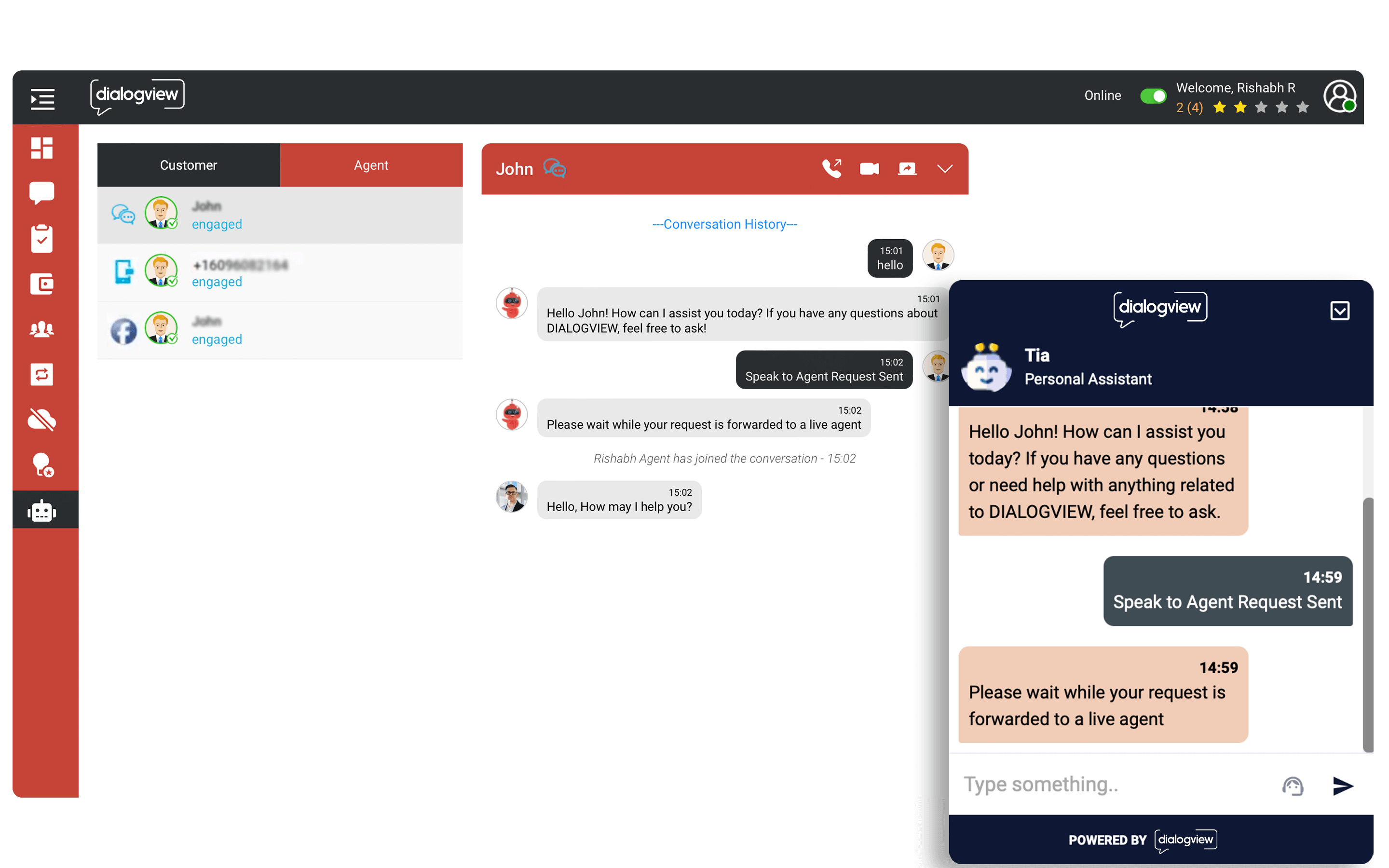

Dialogview Chatbot – Customized AI Solutions for Your Banking Needs

Introducing Dialogview’s AI-Powered Chatbot: A Comprehensive Solution for Banking

- 24/7 Availability: Provides round-the-clock support to customers.

- Personalized Interactions: Uses customer data to tailor responses and recommendations.

- Real-Time Sentiment Analysis: Detects customer emotions to adjust responses accordingly.

- Multilingual Support: Communicates with customers in their preferred language, supporting over 40 languages.

- Secure Transactions: Ensures that all interactions are secure and compliant with regulations.

- Seamless Integration: Integrates effortlessly with existing banking systems and CRMs.

- Scalability: Handles increasing volumes of inquiries without compromising service quality.

- IVR System: Interactive Voice Response system for efficient call management.

- Web Dialer: Capability to receive and make outbound calls, enhancing communication.

- Off-Hours Information: Provides information to customers even during non-business hours.

Why Choose Dialogview?

Dialogview offers a comprehensive customer service suite that includes robust chatbot capabilities tailored for the banking industry. Our platform is designed to enhance customer interactions, streamline support processes, and provide valuable insights to improve overall service delivery.

Conclusion

As the banking industry continues to evolve, integrating advanced chatbot solutions like Dialogview’s generative AI can significantly enhance customer support and streamline operations. By embracing this technology, banks can improve customer satisfaction, reduce operational costs, and stay ahead of the competition.

Ready to transform your banking customer support with AI? Contact Dialogview for a free consultation and discover how our chatbot solutions can elevate your business.