Fintech Industry

Comprehensive Guide to Chatbots in Fintech: 2024

How AI is Revolutionizing Fintech

Artificial Intelligence (AI) is transforming the fintech industry by streamlining operations, enhancing customer interactions, and providing valuable insights for financial institutions. AI-powered tools, particularly chatbots, are at the forefront of this revolution, offering unprecedented efficiency and improved customer service.

What are Chatbots in Fintech?

Chatbots in fintech are AI-driven virtual assistants that interact with customers, employees, and stakeholders. They use natural language processing (NLP) to understand and respond to inquiries, handling tasks ranging from answering common questions to processing transactions efficiently and effectively.

How Chatbots Solve Common Fintech Pain Points

- High Volume of Inquiries: Fintech companies often deal with numerous inquiries daily, leading to long wait times and potential customer dissatisfaction. Chatbots handle routine inquiries, reducing the workload on human agents.

- Complex Transaction Queries: Handling and explaining complex transaction processes can be time-consuming. Chatbots can provide instant, clear, and accurate information about various financial transactions.

- Fraud Detection and Reporting: Managing and reporting fraudulent activities can be challenging. Chatbots can assist by quickly flagging suspicious activities and guiding customers on immediate steps to take.

- Regulatory Compliance: Keeping up with regulatory requirements can be burdensome. Chatbots can help by providing updates and ensuring that customers are aware of necessary compliance measures.

- Financial Education: Providing customers with educational resources about financial products and services is essential. Chatbots can deliver personalized financial education to enhance customer knowledge.

How a Fintech Chatbot Can Benefit Your Business

- Enhanced Customer Experience: Provide 24/7 support, reduce wait times, and offer personalized financial guidance.

- Increased Efficiency: Automate complex queries and transactions, freeing up staff to handle more strategic tasks.

- Fraud Mitigation: Quickly identify and respond to potential fraudulent activities, enhancing security.

- Regulatory Compliance: Ensure customers are informed about regulatory requirements and updates.

- Personalized Financial Education: Deliver tailored financial education to customers, improving their financial literacy.

Conversational AI in Fintech

Conversational AI takes chatbots a step further by enabling more sophisticated interactions. These AI systems understand context, manage multi-turn conversations, and even detect customer emotions to tailor responses accordingly. In fintech, conversational AI can handle complex financial queries, provide personalized financial advice, and assist with compliance-related inquiries.

Seeking More Best Practices for Your Chatbots?

- Ensure Security: Implement strong security measures to protect customer data.

- Continuous Training: Regularly update the chatbot’s knowledge base to keep up with new products and services.

- Human Oversight: Maintain a human-in-the-loop approach to handle complex or sensitive issues.

- User Feedback: Collect and act on user feedback to continuously improve the chatbot’s performance.

Use Cases of Chatbots in Fintech

- Automated Investment Advice: Chatbots can provide personalized investment advice based on user profiles, risk tolerance, and market conditions.

- Loan Pre-Approval: Assist users in checking their eligibility for loans and guide them through the pre-approval process with personalized recommendations.

- Fraud Detection and Alerts: Monitor transactions in real-time to detect suspicious activity and alert users immediately, providing steps to secure their accounts.

- Payment Reminders: Send automated reminders to customers for upcoming bill payments, loan repayments, and other financial obligations.

- Financial Planning and Budgeting: Help users create budgets, track spending, and provide insights on saving and investment opportunities.

- Regulatory Compliance Assistance: Assist users and businesses in understanding and complying with financial regulations and KYC (Know Your Customer) requirements.

- Account Aggregation: Enable users to view and manage multiple accounts from different financial institutions in one place.

- Customer Feedback and Surveys: Collect feedback from customers about products and services to improve offerings and customer satisfaction.

- Real-Time Market Updates: Provide users with real-time updates on stock prices, market trends, and financial news relevant to their interests and investments.

- Interactive Financial Literacy Programs: Engage users with educational content and interactive tools to improve their financial literacy and decision-making skills.

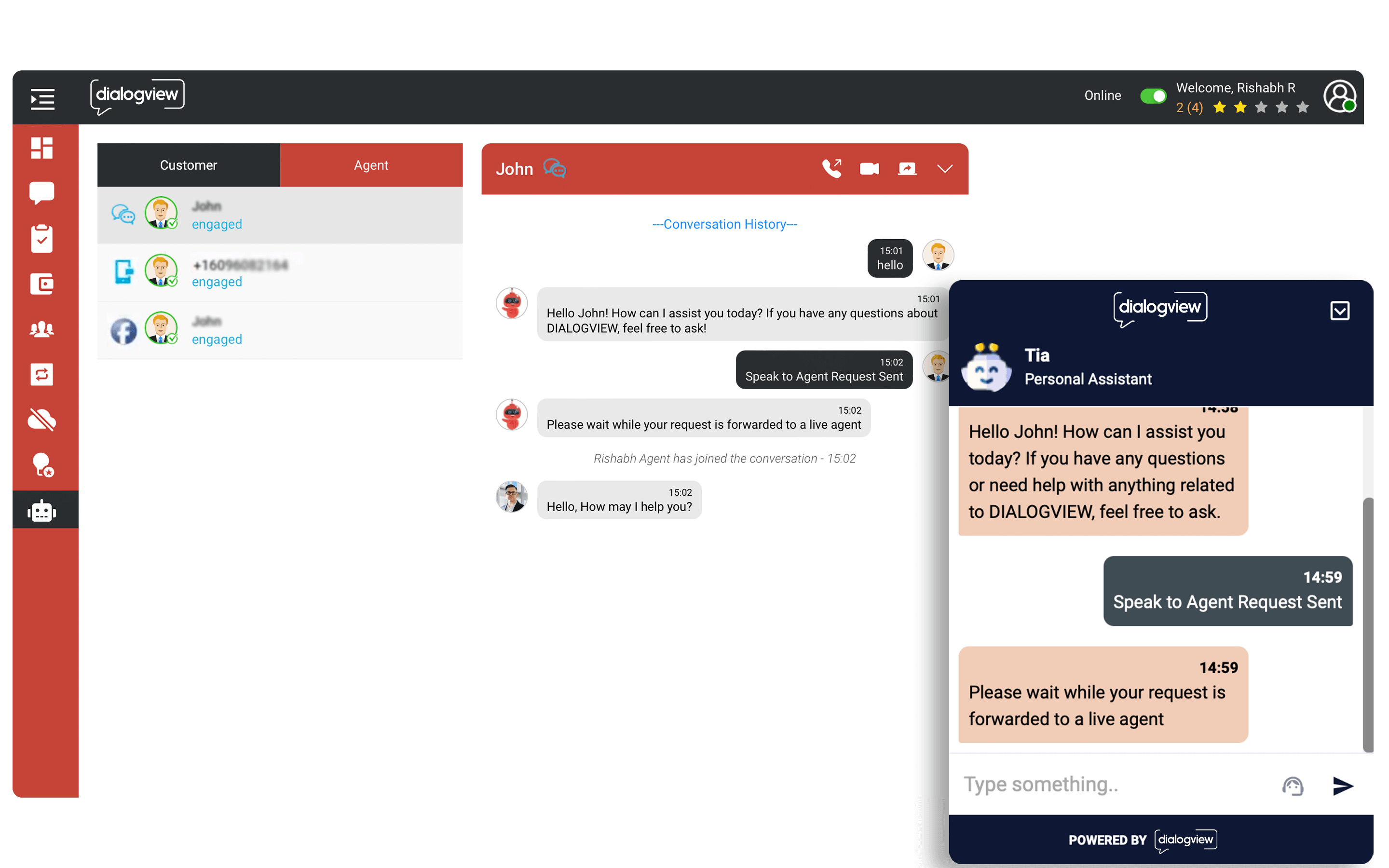

Dialogview Chatbot – Comprehensive AI Solutions for Fintech

Introducing Dialogview’s AI-Powered Chatbot: A Comprehensive Solution for Fintech

- 24/7 Availability: Provides round-the-clock support to customers and employees.

- Personalized Interactions: Uses customer data to tailor responses and recommendations.

- Real-Time Sentiment Analysis: Detects customer emotions to adjust responses accordingly.

- Multilingual Support: Communicates with customers in their preferred language, supporting over 40 languages.

- Secure Transactions: Ensures that all interactions are secure and compliant with financial regulations.

- Seamless Integration: Integrates effortlessly with existing fintech systems and CRMs.

- Scalability: Handles increasing volumes of inquiries without compromising service quality.

- IVR System: Interactive Voice Response system for efficient call management.

- Web Dialer: Capability to receive and make outbound calls, enhancing communication.

- Off-Hours Information: Provides information to customers even during non-business hours.

The Future of Chatbots in Fintech

The future of fintech chatbots looks promising with advancements in AI and machine learning. Chatbots are expected to become more intuitive, capable of handling complex financial queries, providing personalized financial advice, and even predicting customer needs. As these technologies evolve, fintech companies will be able to offer even more personalized and efficient services.

Why Choose Dialogview?

Dialogview offers a comprehensive customer service suite that includes robust chatbot capabilities tailored for the fintech industry. Our platform is designed to enhance customer interactions, streamline support processes, and provide valuable insights to improve overall fintech operations.

Conclusion

As the fintech industry continues to evolve, integrating advanced chatbot solutions like Dialogview’s generative AI can significantly enhance customer support and streamline operations. By embracing this technology, fintech companies can improve customer satisfaction, reduce operational costs, and stay ahead of the competition.

Ready to transform your fintech customer support with AI? Contact Dialogview for a free consultation and discover how our chatbot solutions can elevate your business.