Insurance Industry

Comprehensive Guide to Chatbots in Insurance: 2024

How AI is Revolutionizing Insurance Industry

Artificial Intelligence (AI) is transforming the insurance industry by streamlining operations, enhancing customer interactions, and providing valuable insights for insurers. AI-powered tools, particularly chatbots, are at the forefront of this revolution, offering unprecedented efficiency and improved customer service.

What are Chatbots in Insurance?

Chatbots in insurance are AI-driven virtual assistants that interact with policyholders, prospective customers, and agents. They use natural language processing (NLP) to understand and respond to inquiries, handling tasks ranging from answering common questions to processing claims efficiently and effectively.

How Chatbots Solve Common Insurance Pain Points

- High Volume of Inquiries: Insurance companies often deal with numerous customer inquiries daily, leading to long wait times and potential dissatisfaction. Chatbots handle routine inquiries, reducing the workload on human agents.

- Claims Processing: Managing and processing claims can be time-consuming. Chatbots streamline this process by efficiently gathering information and providing real-time updates to policyholders.

- Policy Management: Keeping track of policy details and providing accurate information to customers is crucial. Chatbots can assist by accessing real-time policy data and informing customers about their coverage.

- Customer Onboarding: The process of onboarding new customers, including gathering information and setting up policies, can be cumbersome. Chatbots simplify this by guiding customers through each step.

- Operational Costs: The need for large support teams to handle customer inquiries increases operational costs. Chatbots automate these interactions, reducing the need for extensive support staff.

How an Insurance Chatbot Can Benefit Your Business

- Enhanced Customer Experience: Provide 24/7 support, reduce wait times, and offer personalized assistance.

- Increased Efficiency: Automate repetitive tasks, freeing up staff to handle more complex issues.

- Cost Savings: Lower operational costs by reducing the need for extensive support teams.

- Data Insights: Gather valuable data on customer interactions to improve services and insurance strategies.

Conversational AI in Insurance

Conversational AI takes chatbots a step further by enabling more sophisticated interactions. These AI systems understand context, manage multi-turn conversations, and even detect customer emotions to tailor responses accordingly. In insurance, conversational AI can handle complex queries, provide personalized policy advice, and assist with claims-related inquiries.

Seeking More Best Practices for Your Chatbots?

- Ensure Security: Implement strong security measures to protect customer and policy data.

- Continuous Training: Regularly update the chatbot’s knowledge base to keep up with new products and services.

- Human Oversight: Maintain a human-in-the-loop approach to handle complex or sensitive issues.

- User Feedback: Collect and act on user feedback to continuously improve the chatbot’s performance.

Use Cases of Chatbots in Insurance

- Policy Recommendations: Assist customers in finding the right insurance products based on their specific needs and profiles, providing personalized policy suggestions.

- Claims Status Updates: Keep policyholders informed about the status of their claims in real-time, providing updates at every stage of the claims process.

- Document Submission Assistance: Guide customers through the process of submitting necessary documents for claims or policy applications, ensuring all required information is provided accurately.

- Renewal Reminders: Send automated reminders for policy renewals, helping customers keep their coverage active without any lapse.

- Premium Calculations: Help customers calculate insurance premiums based on their specific circumstances and coverage needs.

- Telematics Data Interpretation: Use data from telematics devices to provide insights and suggestions for lowering premiums through safer driving behaviors.

- Travel Insurance Assistance: Provide immediate support for travelers needing assistance with policy information, claims, or emergency services while abroad.

- Health and Wellness Tips: Offer personalized health and wellness advice based on user data, promoting a healthier lifestyle and potentially reducing health insurance claims.

- Chatbot for Agents: Assist insurance agents with quick access to policy information, sales support, and lead management, enhancing their productivity and service quality.

- Emergency Support: Provide real-time assistance and guidance during emergencies, such as accidents or natural disasters, helping policyholders navigate through the process efficiently.

- Customer Satisfaction Surveys: Collect feedback from policyholders regarding their experience with insurance services, helping improve customer satisfaction and service quality.

- Policy Cancellation Assistance: Guide customers through the policy cancellation process, ensuring all necessary steps are taken and providing alternatives if possible.

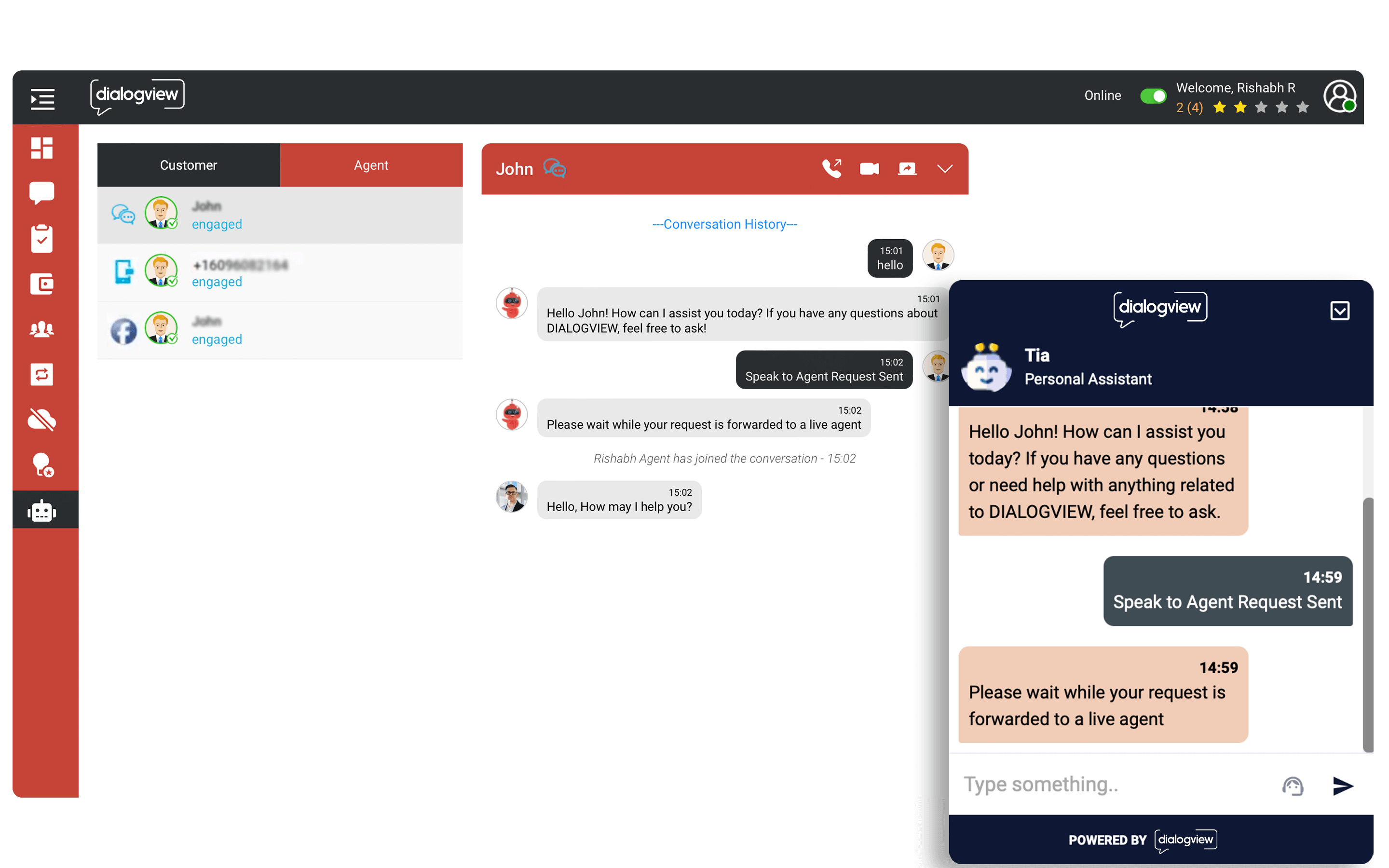

Dialogview Chatbot – Comprehensive AI Solutions for Insurance

Introducing Dialogview’s AI-Powered Chatbot: A Comprehensive Solution for Insurance

- 24/7 Availability: Provides round-the-clock support to policyholders and agents.

- Personalized Interactions: Uses customer data to tailor responses and recommendations.

- Real-Time Sentiment Analysis: Detects customer emotions to adjust responses accordingly.

- Multilingual Support: Communicates with customers in their preferred language, supporting over 40 languages.

- Secure Transactions: Ensures that all interactions are secure and compliant with insurance regulations.

- Seamless Integration: Integrates effortlessly with existing insurance systems and CRMs.

- Scalability: Handles increasing volumes of inquiries without compromising service quality.

- IVR System: Interactive Voice Response system for efficient call management.

- Web Dialer: Capability to receive and make outbound calls, enhancing communication.

- Off-Hours Information: Provides information to customers even during non-business hours.

The Future of Chatbots in Insurance

The future of insurance chatbots looks promising with advancements in AI and machine learning. Chatbots are expected to become more intuitive, capable of handling complex queries, providing personalized policy advice, and even predicting customer needs. As these technologies evolve, insurers will be able to offer even more personalized and efficient services.

Why Choose Dialogview?

Dialogview offers a comprehensive customer service suite that includes robust chatbot capabilities tailored for the insurance industry. Our platform is designed to enhance customer interactions, streamline support processes, and provide valuable insights to improve overall insurance operations.

Conclusion

As the insurance industry continues to evolve, integrating advanced chatbot solutions like Dialogview’s generative AI can significantly enhance customer support and streamline operations. By embracing this technology, insurers can improve customer satisfaction, reduce operational costs, and stay ahead of the competition.

Ready to transform your insurance customer support with AI? Contact Dialogview for a free consultation and discover how our chatbot solutions can elevate your business.